The Technology Industry is witnessing a major transformation especially among its established players. Fear of unknown adjacencies and urgency to leverage on known ones is driving the technology leaders’ adaptation to changes.

MarketsandMarkets™ strongly believes that having a foresight on a new revenue mix and enhancing the company’s relevancy are the key to survive for any company in the fast-changing technology world. This belief is reflected in the M&A strategies of IBM and HCL.

IBM’s urge to become a leader in the hybrid cloud market, which is the future of majority of top 10 firms in every market segment, is clearly visible through its Red Hat acquisition and divestment of legacy stand-alone products. On the contrary, HCL’s aim to move away from labor-intensive software services business to IP (Intellectual Property)-driven business is backed the USD 1.8-billion acquisition of 7 IBM IPs.

IBM’s old revenue mix has become HCL’s new revenue mix. The IBM–HCL deal seems to have similarities with the IBM–Lenovo deal done in the past; for Lenovo, it was hardware; whereas for HCL, it is software product assets / IPs from IBM.

HCL’s acquisition of select IBM IPs / products through a transitional mode is a strategic move for gaining control over the nuances prior to adding them to its portfolio. HCL’s relationship with IBM as a development partner for 5 of the 7 acquired products should have equipped HCL with know-hows and better visibility on monetizing the acquired assets. It is a win-win deal for both IBM and HCL as their long-term relationship will continue, in which, both the companies will sell each other’s technologies.

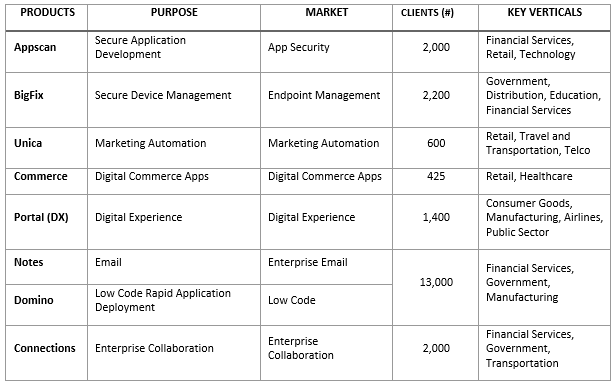

IBM Products Acquired by HCL:

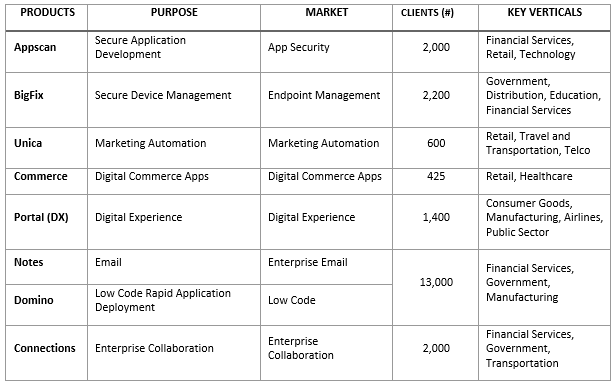

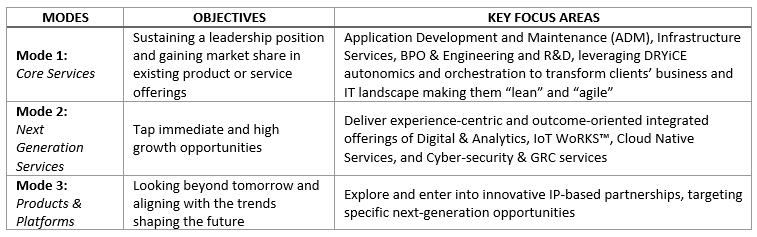

HCL has adopted an innovative “Mode 1-2-3” strategy to enhance its competitiveness in the digital transformation era.

An increasing need for building a long-term wallet relationship with clients has pressed the pedal for HCL’s higher focus on Mode-2 and Mode-3 revenue streams. Addition of the acquired products will play a key role in HCL’s arsenal to power the Mode-3 revenue stream through its strategic segments (Security, Marketing, and Commerce). Furthermore, all 7 acquired products are directly catering to at least one of the following key focus verticals of HCL: Financial Services, Retail and Consumer Packaged Goods (CPG), and Telecom.

The acquisition of 7 IPs / Products from IBM seems to perfectly back HCL’s 5-year plans to increase the revenue share of high-margin business and overtake Infosys’ position as the second largest IT player in India (in terms of revenues). While HCL’s organic growth can help drive its overall revenues close to Infosys’ revenues in 5 years, strategic acquisitions in the IP space can drive HCL past Infosys. Opportunities through large-scale deployments of acquired products will enable HCL to connect and cement its relationship with thousands of clients worldwide; including the expected 5,000 clients of IBM’s select products.

However, “Will HCL, a software services firm, be able to transform into a software product firm to the best of its acquired client base and shareholders?” is a major question in the minds of the company’s stakeholders and industry analysts. For this, HCL’s conservative management holds the key with clearly articulated strategies to accommodate and monetize acquired assets and clarity on potential risks in client base erosion. As of now, the HCL management has a task to provide confidence that HCL could turn the acquired select products of IBM into a lucrative investment for its stakeholders.